Product

Using AI to optimize payments performance with the Payments Intelligence Suite

We introduced our Payments Intelligence Suite, which uses AI to make hundreds of automated, real-time decisions to maximize your profits.

We introduced our Payments Intelligence Suite, which uses AI to make hundreds of automated, real-time decisions to maximize your profits.

We announced the ability to manage multiple payment providers from within Stripe, two new extensibility primitives, support for turnkey consumer issuing programs, new money management capabilities, and a lot more.

Over the last year we’ve seen a 40% increase in the share of noncard payment volume on Stripe. To help you adapt your fraud prevention strategy to this changing set of payment method preferences, we’re extending Radar’s fraud protection to cover ACH and SEPA payments.

Last week, we shared new data that helps businesses understand the conversion and revenue benefits of offering different payment methods. Now we want to share how we ran the experiment. As we explain in the rest of this post, we had to test millions of combinations of payment methods while ensuring that we maintained a consistent shopping experience for customers.

Give customers in France the option to pay with Alma, so they can choose to complete their purchase in two, three, or four installments—while you get paid immediately.

Businesses in the UK can now offer Pay by Bank. Accept payments in real time, and reduce payment costs with Stripe’s open banking–powered payment method.

Businesses in the US can now offer Amazon Pay. Allow your customers to pay using the same checkout experience that millions of Amazon customers know and trust.

Manual payouts will now land in your bank account on the same business day due to new local banking integrations in the UK. No extra fees, no integrations changes needed.

Businesses in the US can now reach new customers with Cash App Pay. Allow customers to pay with the wallet that's number one in both app stores.

Build custom experiences for interactions from ordering to loyalty management—or run your custom POS on an all-in-one device.

Businesses can now accept more buy now, pay later methods globally through one integration on Stripe: Klarna in AU, NZ, CA, CH, PT, PL, CZ, and GR; Affirm in CA.

Integrating and upgrading to the Payment Element is now easier than ever with server-side confirmation and a new integration path that lets you collect payment details before creating a PaymentIntent or SetupIntent.

Businesses in the US and Canada using Checkout and Payment Links can now dynamically localize pricing to 30 countries with one click in the Dashboard.

Businesses can now accept in-person payments in Switzerland and Norway with Terminal's flexible APIs, SDKs, and pre-certified card readers.

We have data that shows when at least one additional relevant payment method beyond cards is dynamically surfaced, businesses on average see a meaningful increase in conversion and revenue.

Last month, we improved our AI tooling to give you even more flexibility when combating fraud. Now, Radar’s new rules combine our machine learning models with the issuer’s CVC and postal code response in real time. This can help you minimize fraud while worrying less about accidentally blocking legitimate revenue.

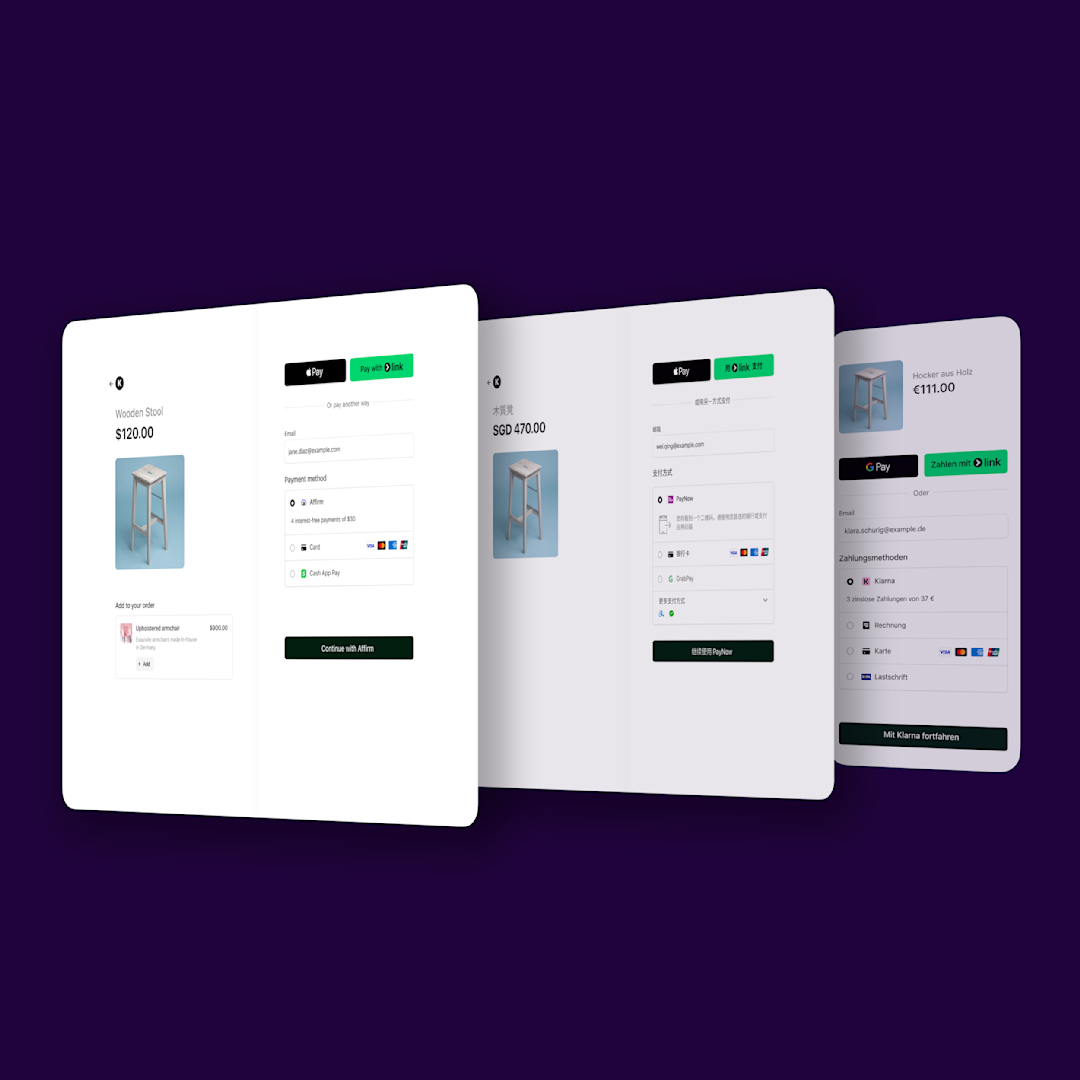

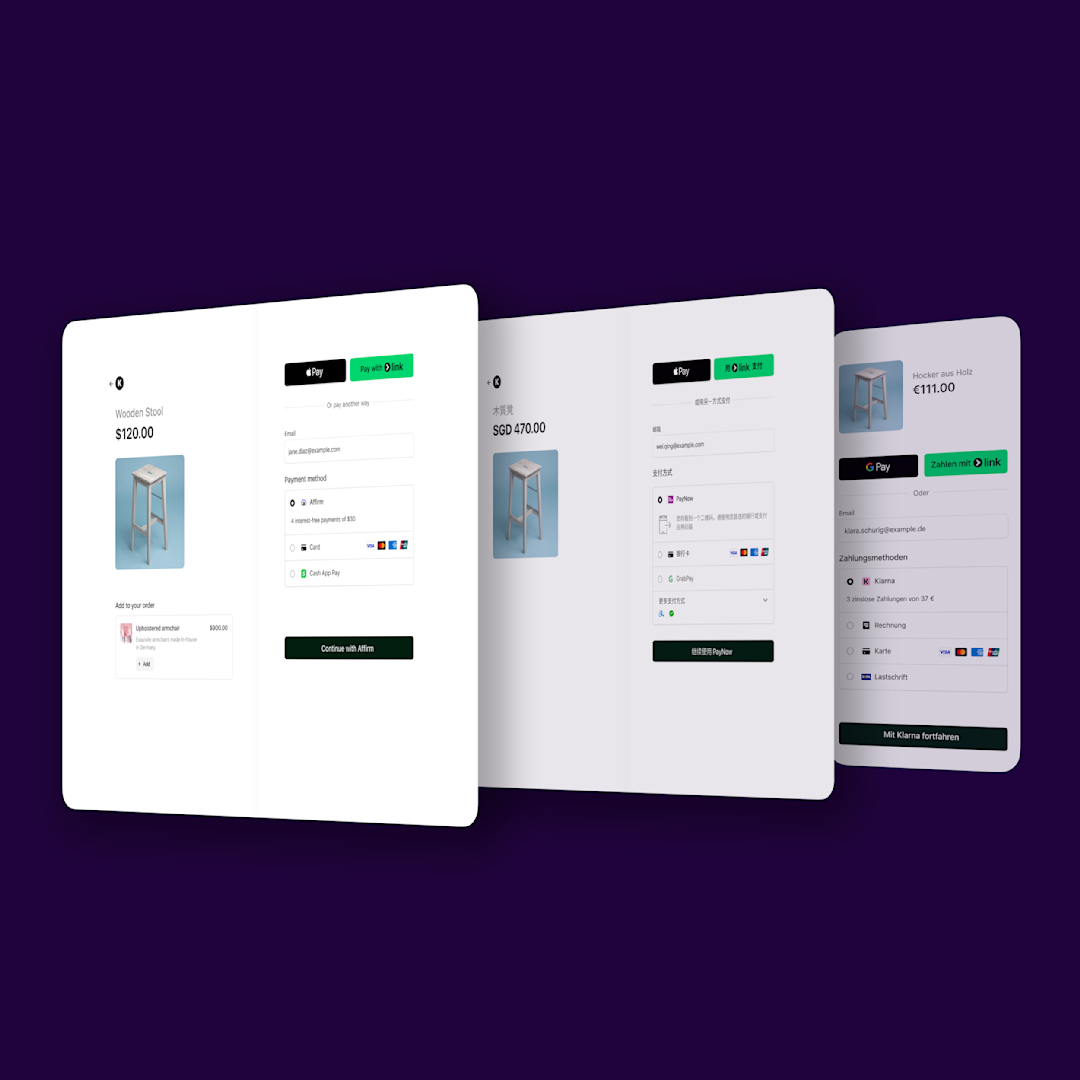

The Optimized Checkout Suite uses AI to personalize the checkout experience—dynamically adjusting everything from payment method ordering to fraud interventions in order to maximize conversion and boost revenue.

Fleet businesses can build their Issuing program to support virtual cards for optimizing fleet spend to approve or decline authorizations requests in real time with Visa Fleet 2.0. Learn more

You can now bill different subscription frequencies, such as annual and monthly fees, in a single invoice. Learn more

You can now set up a custom URL in customer emails that directs customers to your subscription cancellation process. Learn more

All core Billing metrics now support interactive features including drill-down analysis, custom filtering, and flexible grouping options for enhanced data exploration. Learn more

All subscription renewal and free trial completion emails will now automatically include a cancellation link that directs to the customer portal. You can also create a custom URL for your cancellation flow. Learn more

Revenue Recognition now automates accounting calculations and reporting for usage-based billing events, enabling revenue tracking in line with ASC 606 and IFRS 15 standards for arrears billing (preview). Learn more

Users in the US and UK can now send money directly to third parties with just their email address. Global Payouts offers several integration paths with no-code, hosted, and API solutions that allow your business to send and track payouts globally without requiring you to use Stripe for Payments (preview). Learn more

Platforms in the UK and certain European countries can launch a charge card program, allowing cardholders to spend from a line of credit with a fixed repayment window while Stripe manages all the licensing and compliance (preview). Learn more

Billing analytics now features enhanced benchmarking, with Stripe automatically identifying peer businesses based on industry sector and operational factors. This enables you to more effectively track and compare your performance against similar businesses on Stripe. Learn more

Billing analytics now includes a rated usage metric, enabling detailed tracking of usage-based revenue. Learn more

You can now use rate cards and Stripe’s Optimized Checkout Suite to seamlessly process authorizations and activate pricing plans (preview). Learn more

Platforms serving US multinational companies can now issue cards to employees of subsidiaries in select countries outside of the US (preview). Learn more

For one-time invoices paid via the hosted invoice page, you can now choose whether you want a payment method to be saved automatically. New Stripe accounts default to not saving payment methods automatically. Learn more

Businesses can maintain full control of their banking relationships or use their own licenses for their Issuing program while Stripe acts as the processor. Learn more

You can now easily write complex Issuing authorization rules through a no-code Dashboard (preview). Learn more

You can now access Authorization Boost, a unified solution that brings together all our authorization and cost optimizations to increase your revenue and reduce costs. Learn more

Billing analytics metrics now surface transactional data within one hour of the time that it’s generated, providing near real-time visibility into your billing data. Learn more

You can now centrally view subscriptions and invoices from across accounts in your organization. Learn more

Card installments are now available in Japan (preview). Learn more

You can now easily integrate and route payments to other processors with full visibility and control (preview). Learn more

You can now view the security history for Dashboard actions taken at the organization level. Learn more

Sigma is now available in test mode, allowing you to build and validate custom reports in your sandbox environment. Learn more

You can now centrally review and remediate compliance requirements for connected accounts from across your organization. Learn more

You can now centrally view and manage disputes from across accounts in your organization. Learn more

You can now share customers and their payment methods across accounts in your organization to avoid recollecting your customers’ payment information multiple times (preview). Learn more

You can now configure event destinations at the organization level to receive events for accounts in your organization. Learn more

You can now send additional transaction metadata across supported payment method types to access cost savings, facilitate payment reconciliation, and potentially improve auth rates (preview). Learn more

Elements with CheckoutSessions API enables businesses to use the customizable UI of Elements with the less code-intensive Checkout Sessions API and integrate with other Stripe products, such as Tax, with just a single line of code. Learn more

Revenue Recognition now supports bulk import for chart of accounts mapping, streamlining setup for users managing large numbers of general ledger accounts (preview). Learn more

You can now use the Foreign Exchange Quotes API to display prices in local currencies, lock in exchange rates, and check real-time rates and FX fees (preview). Learn more

You can centrally view and analyze payment analytics across accounts in your organization. Learn more

Our Vault and Forward API now supports 12 endpoints for payments providers. Learn more

Adaptive Pricing has now expanded to additional integration types, Elements with CheckoutSessions API and Hosted Invoice Page. Businesses on these integrations can now automatically present localized prices to customers in 150+ countries. Learn more

You can now turn on Data Pipeline for accounts in your organization and add new accounts to your existing Data Pipeline setup. Learn more

You can now create sandboxes for your organization that mirror your live mode account structure so you can test your organization’s payment integration. Learn more

The network cost insights report is now available in Canada for users with network cost plus pricing. The report provides increased visibility into network fees to help you identify cost savings opportunities. Learn more

Revenue Recognition now features a redesigned interface with in-Dashboard preview capabilities, making it easier to review and analyze your accounting reports and statements. Learn more

Visualize and understand relationships between reporting tables through an interactive entity relationship diagram (ERD) available to all users in docs. This makes it easier for Sigma and Data Pipeline users to explore and query data across multiple tables. Learn more

Use an embeddable component to embed a list of payment methods directly in your app. Learn more

The AI model built into the Optimized Checkout Suite now uses a combination of on-session data and network signals to intelligently determine which payment methods to display and in which order, helping increase conversion. Learn more

Data Pipeline now delivers data to your data storage destination within 6 hours of generation, enabling more current data for analysis and centralized reporting. Learn more

Platforms using Stripe Connect and Stripe Billing can now reduce transaction costs by collecting subscriptions from their connected accounts’ Stripe account balance (preview). Learn more

Data Pipeline is now available in test mode, enabling you to test data exports and integrations in your sandbox environment. Learn more

Custom payment methods enable businesses to display additional payment methods that are not processed through Stripe. Businesses on Stripe can now add any payment method—from any processor—to the Payment Element with just a few lines of code. Learn more

Sigma now offers API access to query data and manage associated resources like templates and executions. This enables programmatic control of your Sigma reporting and analytics. Learn more

You can now use Sigma to centrally build custom reports and analyze data from across accounts in your organization. Learn more

Revenue Recognition now reflects audit changes in invoice-level journal entries immediately. Learn more

You can now see additional quantifiable recommendations for specific actions to improve your payments performance, such as how much revenue you can gain by adding a digital wallet. Learn more

You can now access a consolidated view of card acceptance analytics across your business in Organizations and filter card acceptance data by third-party payments processors if you’re a multiprocessor user. Learn more

Stripe Tax expands support for remote sellers of digital goods to 12 additional countries: Aruba, Azerbaijan, Bangladesh, Benin, Burkina Faso, Cameroon, Cape Verde, Ethiopia, India, Kyrgyzstan, Laos, and the Philippines. Learn more

Stripe Billing and Checkout users who use a third-party tax solution like Anrok, Avalara, and Sphere can now integrate those solutions with Stripe Tax apps (preview). Learn more

Stripe Tax now supports shipping cost allocation, applying country- and state-specific tax rules for calculating shipping fees. Learn more

You can now create, iterate, and manage complex usage-based pricing models with rate cards (preview). Learn more

Platforms can now use the Accounts v2 API to create one object representing a connected account across Stripe Connect and Stripe Billing (preview). Learn more

Users in the UK can now store money, convert between currencies, send money to users in 80+ countries, receive funds via local bank account details, and spend with virtual and physical cards (preview). Learn more

You can now use natural language to complete tasks in the Dashboard—for example, creating products, processing refunds, and generating payment links—with our AI-powered Dashboard assistant (preview). Learn more

A redesigned list view gives platforms greater visibility into connected account health with 14 new filters, customizable columns, and detailed insights in the Stripe Dashboard. Learn more

You can now join a waitlist to use a new discount type for `percentage off up to maximum` amount; this is powered by a Stripe-authored script (preview). Learn more

You can now join a waitlist to update and manage versions of usage-based pricing and product packages across cohorts in the Dashboard (preview). Learn more

Accessible in 100+ countries, users can store, receive, and send funds either via cryptocurrency or traditional financial rails such as ACH, SEPA, and wire with Stablecoin Financial Accounts (preview). Learn more

Platforms can now use embedded components to optimize user onboarding flows directly in their mobile app with new iOS and Android SDKs. Learn more

Terminal supports an expanded portfolio of third-party hardware, starting with Verifone. This includes automated ordering and fulfillment, on-reader experiences, and device management. Learn more

Radar users can now request access to Radar risk scores for transactions processed outside of Stripe. Learn more

Platforms can view support case analytics for connected accounts and gain insights into support volume and the top issues encountered by those accounts. Learn more

Users in the Czech Republic, Denmark, Hungary, New Zealand, Norway, Poland, Sweden, Romania, and the UK can now withdraw their funds to debit cards in addition to bank accounts with Instant Payouts. Learn more

Users in the US can now store money, send money to users in 80+ countries, receive funds via local bank account details, and spend with virtual and physical cards (preview). Learn more

You can now join a waitlist to write custom discount logic using Stripe Scripts in Stripe Billing (preview). Learn more

Platforms can now use the Dashboard to view business performance data (including revenue, margin, and account growth), personalized growth recommendations, upcoming account restrictions, and tasks (preview). Learn more

Platforms can now increase access to financing opportunities for their previously ineligible users by providing Stripe with third-party payment sources (preview). Learn more

You can configure your usage-based business model with a no-code rate card editor in the Dashboard (preview). Learn more

You can now request access to Stripe’s dispute prevention solution to automatically resolve disputes across Visa and Mastercard transactions (preview). Learn more

Stripe Tax is now an all-in-one global tax compliance solution. It manages obligation monitoring, registrations, calculations, collections, and filings—all in one place. Learn more

Platforms can now provide access to financing offers for their connected accounts located in the United Kingdom. Learn more

Businesses in the US can now offer UPI, a popular local payment method in India with more than 350 million customers. Learn more

Businesses in the US can now offer Pix, a popular local payment method in Brazil with more than 150 million customers. Learn more

PayPay is now available in Japan (preview). Learn more

Founders can now accept payments immediately after incorporation, while Atlas handles the IRS filings in the background.

Recent AI upgrades to Adaptive Acceptance led to a record $6 billion in false declines recovered in 2024—a 60% year-over-year increase.

With the rise of usage-based billing for AI services, the strategic importance of credits is growing. That’s why we’ve recently added a new credits feature to Stripe Billing.

Join us May 6–8 in San Francisco for Stripe Sessions, our annual user conference. This year, we’re doubling the number of breakout sessions, expanding our training program to give you more hands-on product support, and adding a demo stage to showcase more of Stripe’s key updates.

We announced AI-powered payments, our biggest-ever upgrades to Stripe Connect, new support for usage-based billing, increased interoperability, and a lot more.

Please join us April 23–25 at Moscone West in San Francisco for our largest event ever.

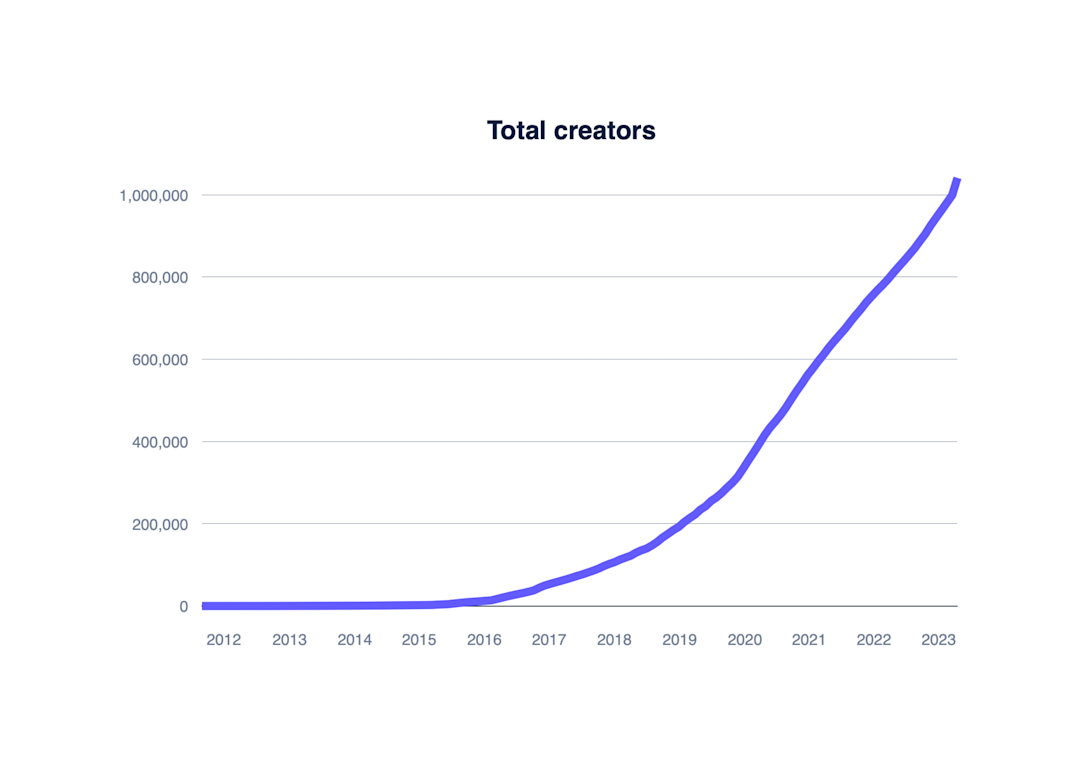

Stripe data shows that the creator economy has evolved but is still thriving. We’ve seen this evolution up close, as many of the largest creator platforms use Stripe Connect to onboard creators and pay out funds around the world.

At our annual user conference, we shared how we are helping businesses increase revenue with our global payments suite, how we are allowing platforms and marketplaces to generate more revenue and get to market faster, and how we are helping businesses find new efficiencies through developer tools and automated revenue and finance operations.

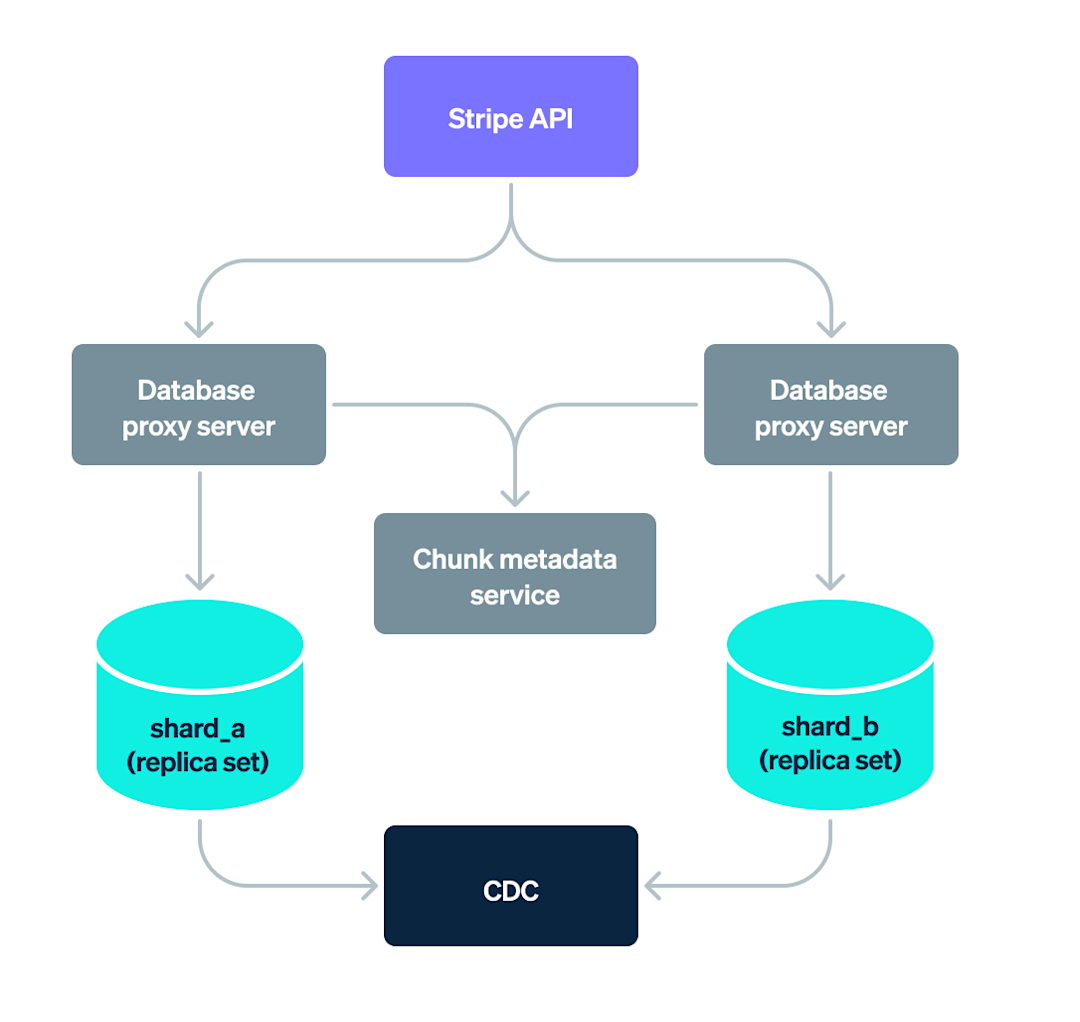

In this blog post we’ll share an overview of Stripe’s database infrastructure and discuss the design and application of the Data Movement Platform.

Stripe Billing allows businesses to manage customer relationships with recurring payments, usage triggers, and other customizable features.

This blog discusses the technical details of how we built Shepherd and how we are expanding the capabilities of Chronon to meet Stripe’s scale.

In this blog post, we’ll share technical details on how we built this state-of-the-art money movement tracking system, and describe how teams at Stripe interact with the data quality metrics that underlie our payment processing network.

You can now configure payment method settings from the Dashboard—no code required. We call this integration path dynamic payment methods.

Last week, we shared new data that helps businesses understand the conversion and revenue benefits of offering different payment methods. Now we want to share how we ran the experiment. As we explain in the rest of this post, we had to test millions of combinations of payment methods while ensuring that we maintained a consistent shopping experience for customers.

We have data that shows when at least one additional relevant payment method beyond cards is dynamically surfaced, businesses on average see a meaningful increase in conversion and revenue.

In our new report on the state of billing, we highlight trends and insights from more than 2,000 subscription business leaders from around the world. We learned that churn continues to be a looming concern, with 72% of survey respondents saying they are worried about churn impacting their bottom line.

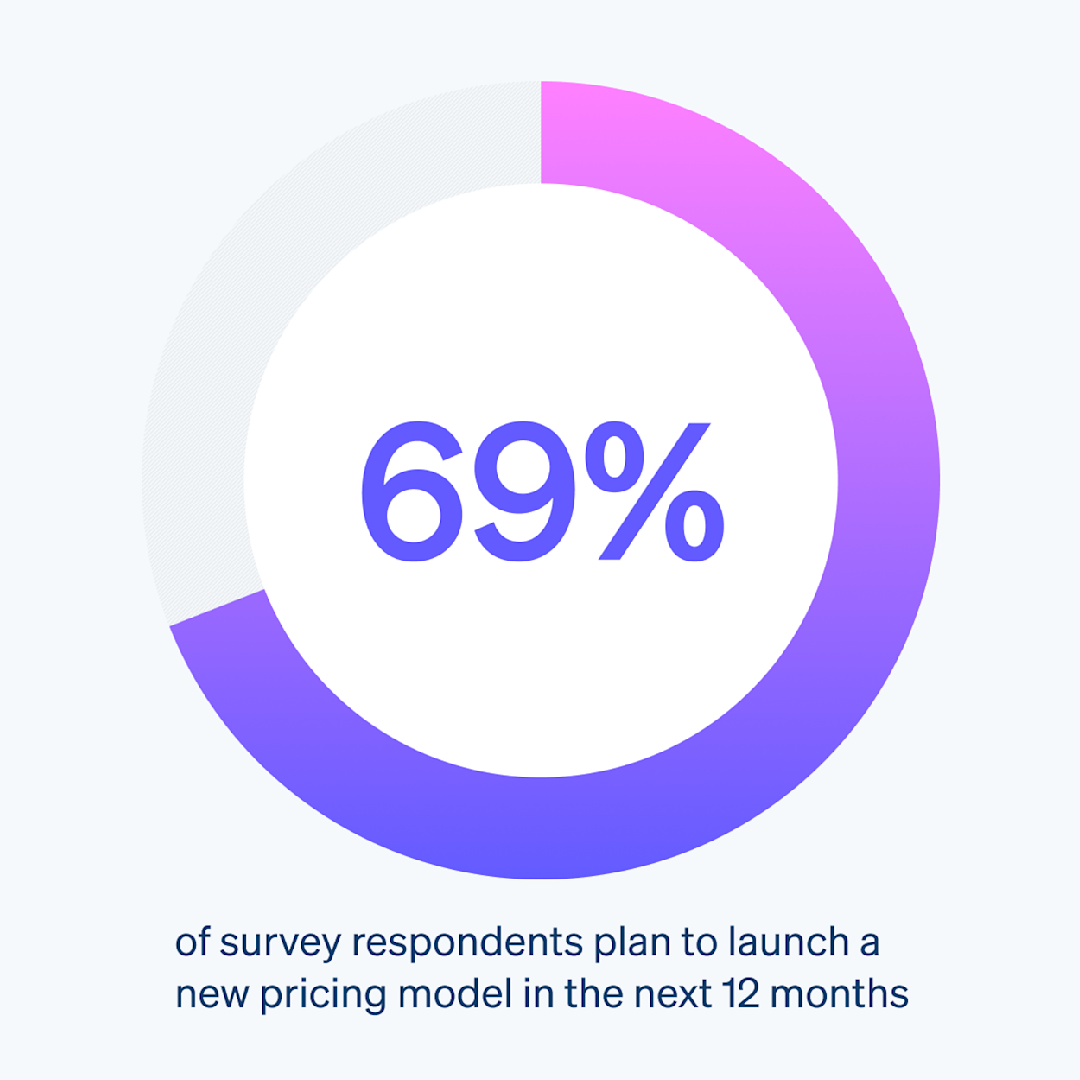

We surveyed more than 2,000 subscription business leaders from around the world to understand how they are responding to the growing trend of pricing-as-a-product. We learned that businesses increasingly want to experiment with pricing models, but there is one thing in their way: their billing systems.

Global businesses have told us they’re interested in replicating the fraud prevention success seen in Europe by requesting 3DS. Last year, we had a front-row seat as several Stripe users chose to do exactly that, but the results in the US were very different from what we have seen in Europe.

We announced the ability to manage multiple payment providers from within Stripe, two new extensibility primitives, support for turnkey consumer issuing programs, new money management capabilities, and a lot more.

Over the last year we’ve seen a 40% increase in the share of noncard payment volume on Stripe. To help you adapt your fraud prevention strategy to this changing set of payment method preferences, we’re extending Radar’s fraud protection to cover ACH and SEPA payments.

Last month, we improved our AI tooling to give you even more flexibility when combating fraud. Now, Radar’s new rules combine our machine learning models with the issuer’s CVC and postal code response in real time. This can help you minimize fraud while worrying less about accidentally blocking legitimate revenue.

The Optimized Checkout Suite uses AI to personalize the checkout experience—dynamically adjusting everything from payment method ordering to fraud interventions in order to maximize conversion and boost revenue.

Founders can now accept payments immediately after incorporation, while Atlas handles the IRS filings in the background.